Why is Whisky a Good Investment?

10-01-2023

Why Choose Whisky Casks To Invest In?

Originally published on 10/02/2022

Updated on 19/02/2025

The most compelling reason for investing in whisky at the moment is that so many people have invested, which is substantial because whisky as an investment asset for the larger retail investment class has emerged very recently. Whisky is nearly an untapped niche for serious investors and, in a period when redundant capital has chased up the prices of nearly everything else, it is worth a look, on those grounds alone. The more you look the more meaningful it becomes.

Briefly – lets look at the investment fundamentals of the whisky value chain and decide is whisky a good investment or not?

There are two primary ways to invest in whisky

- Bottle Investment – This involves purchasing whisky bottles, either old or new. The brand and distillery play a crucial role in determining their value and appreciation over time.

- Cask whisky Investment – This method allows investors to own whisky in casks, where the specific distillery is less important. The blended whisky market consistently demands casks, making them a reliable investment. Returns typically range between 10-15%, with even lesser-known distilleries offering strong potential for growth.

Investing in Bottles or Casks Whisky Investment

The challenge with bottles is that you need a lot of them to make a market, and that requires a lot of investments. Sourcing the right bottles, through auctions or new releases, takes time, experience, and patience.

Casks are a different story. As blended whisky, there's a stronger demand for casks. Investing in Scotch whisky casks can be a simple asset, held in bonded warehouses in Scotland and no duty is levied while it stays there.

From a tax perspective, whisky is considered a depreciating asset under the local laws, there's no ‘taxes on capital gains’ payable on its trade in the local market (where it's stored).

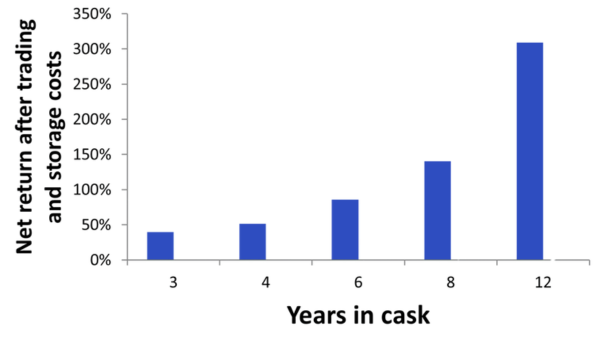

How do you get to buy the right casks whisky for investment? As with any investment portfolio, diversification is important. Casks can be bought freshly- filled to well- aged. A cask at zero age is called a ‘new fill cask’. The liquid is called ‘new make spirit ‘and will legally become whisky after three years. Casks can also be bought at any age beyond. The casks become more valuable with maturity and the rate of return grows exponentially with age.

Another key factor in cask whisky investment is the type of oak used for storage. Whisky casks come in three types:

- First Fill Cask: Similar to a fresh tea bag, it imparts strong flavors quickly, making it ideal for younger whiskys (up to 12 years).

- Refill Cask: Milder in intensity, it takes longer to add flavor, making it better suited for older whiskys.

Rejuvenated Cask: A used cask with its surface shaved to expose fresh wood, offering a balanced flavor profile.

When investing, a first fill cask is best for younger whiskys, while refill casks are more suitable for older whisky, as they help maintain a smoother taste over time.

Types of Oak used in Cask

When investing in whisky, the type of oak used in the cask matters.

- American Oak gives whisky sweet, vanilla flavors and is widely used—about 90% of Scotch whisky is aged in it.

- European Oak is rarer, with spicy and nutty flavors. Whiskys aged in European oak casks, like Sherry casks, are more sought after and can command higher prices.

For cask whisky investment, a first-fill European oak cask can be a great choice, especially if the whisky is being sold to independent bottlers who may mature it further before bottling.

There are blended whiskies that like to have a good percentage of content from rejuvenated casks as well. These are much-used casks whose surface wood has little flavour left, so a couple of millimetres are shaved off the inside to expose active wood, ready for reuse. They have a different flavour profile, impart flavour at a similar rate to a first fill cask, so blenders can use the whisky earlier and they are less expensive.

The blending industry is enormous. The category accounts for almost about 22% of British F&B exports on its own. That supports a substantial market for commodity whiskies which are traded for use as ingredients in the blends. Unlike the high premium malt brands these lesser-known spirits are similarly priced across many varieties and price discovery is similar to other commodities. Older whisky commands higher value, generating solid returns for investors who sell aged casks to brand owners for direct sales or blending. This makes aged whisky a reliable asset in the whisky investment market.

“Too much of anything is bad, but too much good whisky is barely enough.” - Mark Twain[1]

whisky is not a ‘crowded trade’ and neither is it extremely volatile

Unlike equities, bonds, Cryptos and property, whisky has attracted very small investments as an asset class for a long time.

In real terms the cost of newly distilled malt whisky has continued falling steadily. Over a similar period, typical investing in whisky as assets have at least doubled in real terms (equities +170%, houses +124%); as per global averages (which are much lower than emerging markets).

Adjusted for inflation both types (malt or grain) of whisky currently cost less than half the 1972[2] price when bought new.

Source: whiskyInvestDirect.com

Cask Whisky Investment

Unlike traditional assets like real estate, stocks, and bonds, whisky investment is still a niche market. While millions invest in these common asset classes, only a few thousand people hold a significant amount of maturing whisky in their portfolios. This makes investing in Scotch whisky or cask whisky investment a unique and less crowded opportunity with strong potential for growth.

If you are still wondering, is whisky a good investment? Let me tell you about whisky’s last returns:

Whisky's financial returns over the last decade have averaged around 8% to 9% per annum (after storage expenses). While the price of newly distilled whisky has dropped, the value of maturing whisky continues to rise, making cask whisky investment a strong option.

Unlike most stored goods, whisky improves with age, increasing in value over time. This makes it a unique asset with a low risk-to-reward ratio, especially compared to traditional investments. For those looking for the best whisky to invest in, aged casks offer a reliable and profitable opportunity.

The overall rate of return has remained high enough through the years to provide profit to both producers and to those who finance an average of nine years of stockholding.

whisky casks have consistently generated robust historical returns when evaluated as an investment. Each asset included in an investment portfolio needs to be grounded in data that demonstrates its earning potential over time. While all the other benefits are important, the number one reason to invest in whisky is quite simple, you can earn better returns with elapsed time. Over the past 5 years’ whisky casks have generated an average return of 12.4% per annum, with popular distilleries delivering even greater returns. There are few physical assets that can boast such robust levels of growth under every economic cycle.

“There is no such thing as a bad whisky. Some whiskies just happen to be better than others.” - William Faulkner

Whisky Investment’s Historical Performance and Future Outlook:

The market performed exceptionally last year, but this is just part of a steady trend over the past five years. The Apex 1000 index has surged 162.91% since 2014, outperforming gold by over 150% and the FTSE by over 160%. As interest in alternative investments grows, investing in Scotch whisky continues to stand out for its strong returns.

However, with more investors entering the market, challenges arise. The average bottle price has increased by over £100, and the volume of whisky on the second-hand market has grown by more than 200% since 2014. This makes selecting the best whisky to invest in crucial, particularly for those focusing on bottle investments. For investors considering cask whisky investment or looking to buy whisky barrel investment, ensuring the right purchase at the right price is key to maximizing returns.

According to Knight Frank’s Wealth Report 2021, the value of rare whisky has risen by 478% in the last 10 years, whereas the value of classic cars increased by 193%, fine art by 71%, and wine by 127%. This makes investing in Scotch whisky and Irish whisky investment an increasingly attractive opportunity.

Irish whisky is an emerging market that has bounced back over the last two decades and is currently growing at double digits. The market is projected to continue its strong growth for the next 20 years. As demand for whisky to invest in grows and more brands enter the market, they will require mature stock to produce their own whisky. This is where investors benefit, as they can sell mature casks to new brands meeting the global surge in Irish whisky investment. In the next 10 years, over 100 new brands are expected to enter the market.

The Scotch whisky market is more established, with a variety of providers sourcing whisky. This creates a strong secondary market for investors. As the most traded spirit globally, the value of high-quality Scotch single malt whisky is set to grow from £394m in 2018 to £439m in 2022, making it a strong option for those looking to invest in Scotch whisky.

Experts predict the growth of Irish whisky will continue at double digits for at least 20 more years. The IWSR (International Wine and Spirits Record), the global benchmark for alcohol and beverage data, forecasts Irish whisky will outgrow Scotch and Bourbon. Similarly, the IWA (Irish whisky Association) anticipates the market will double in the next 10 years, reinforcing its potential as one of the best whisky investments available today.

Scotch Single Malt sales are rising annually in what is the world’s most stable whisky market. Therefore, it is another very safe play to be holding maturing Scottish Single Malt casks for the future. The emerging markets are witnessing unprecedented growth in imports of single malts, and there is a rising trend of early adopters of whisky, which is replacing beers as the drink of choice for the young in emerging markets.

Due to this, whisky presents excellent opportunities, even when the world is troubled due to the extended pandemic and its larger implications on various economies. The opportunity is not lost on sophisticated wealth managers and their clientele, making investing in Scotch whisky a compelling and stable option.

Investing in Scotch whisky is by far the most successful type of whisky and best whisky to invest in around the world. The established reputation of their distillers and its geographical identity as a heritage product of Scotland mean that Scotch is usually the first thing that comes to mind at the mention of ‘whisky’. However, the Japanese market is currently also noting impressive growth. The Japanese Icon 100 Index has seen a 38% increase over the past 12 months and whiskyStats declared it the best-performing whisky-producing region. Japan out-performed second-place region Campbeltown, Scotland; by 15%.

Though wine is typically considered the pinnacle of consumable investments, the performance of the Scotch market says differently. Last year, the average bottle price for wine was £165, a far cry from the £377 paid for whisky. Both wine and whisky saw the world record broken for the highest price paid at auction for a single bottle last year, but whereas the 73-year-old bottle of Burgundy sold for around £430,000, a 60-year-old Macallan fetched £1,000,000. This record has also since been broken in 2019 by a bottle from the same cask which sold for £1.5m.

Though alternative investment assets are generally close to the investor’s interests, the returns that can be found in whisky investment are likely to make this market much more attractive to a more varied audience in the near future.

As a note of caution, as with any investment and its underlying asset class, do undertake your own research and due diligence, before you jump in to invest. Make sure you’re fully aware of just what you are purchasing and seek expert advice beforehand, not just for purchase, but also on the means to liquidate and exit, if you need to.

“The cash price for 8-year old Scotch whisky bought new, and sold each year of the decade 2011-2020 shows average historical returns of 15.4% per annum. This number is net of our trading commission. However you would have paid storage fees of 15p per Litre of Pure Alcohol (LPA) per year, bringing the return down to 11.7% p.a”. - whiskyInvestDirect.com

How To Start Your Investment in Whisky?

Like any investment categories whisky too has active and passive options. You could invest for the long haul by investing with bottles or casks or invest in funds and ETFs in the passive mode.

There are whisky funds globally which allow you to invest without requiring much expertise. However, this method could require high investment by value, especially if the fund’s makeup largely consists of whiskies that are old and rare.

For example, Rare Finds Worldwide has launched its Rare Single Malts fund targeting Asia-based family offices and high-net-worth investors. The fund aims to acquire rare whisky casks with bottles and collections between 15 and 40 years old, with minimum initial investment of $132,000 needed to join in.

Then there’s Wave Financial's Wave Kentucky whisky 2020 fund which bases their rate of return on acquiring and selling up to 25,000 barrels of bourbon whisky from the Wilderness Trail Distillery in Kentucky, USA. The fund has a six-year investment horizon and aims to generate a 20% IRR across this period of time.

Alternatively there is The Single Malt Fund, which you can invest in and then either trade its shares in the Nordic Growth Market in Sweden or mimic the investment and purchase the underlying whisky that the fund acquires. The fund is actively managed and aims to continuously buy and sell limited edition bottles of whisky on a global scale. A minimum subscription of 1,000 euros is required to join this.

There is no single industry benchmark for wholesale pricing of whisky. This can make it hard to assess the value of whisky and difficult to see how whisky is performing as an asset class. Once you have decided you would like to invest in whisky, the biggest question is the distillery whose whiskies to invest in. Like the scripts in the stock market, distilleries’ value and popularity go up and down in time. The popular ones are like Blue Chips, with limited downside risks, as almost everyone in the whisky world knows them and they do attract premiums. These are mostly the Single Malts from Scotland and a few ones from the USA.

The Rare whisky 101 Investors index shows the distilleries which are performing the best as an investment. The index is based on actual UK auction data and charts the percentage change in the value of all bottles from a distillery with a small weighting on the average price of all bottles and the highest single bottle from that distillery.

While the investment modes vary between passive investment in ETFs and traded funds (like mutual funds) to direct and active investments like owning bottles and casks directly; the investor class also varies when it comes to investing in whisky.

Category of Investors: Investors could be divided into three categories, collectors focused on building a prized inventory; professional investors who are seeking with bigger buying power; and connoisseurs focused on consumption.

Investing in alcohol is by no means a new trend. People have been investing in wine for many hundreds of years; though whisky is new, and as a structured investment product is a recent addition to the alternate asset landscape.

That's probably why many rookie and seasoned investors like to stick with well-known and high-valued Scotch whisky brands like Macallan, Highland Park, The Balvenie, Glenmorangie, Ardbeg, and Bowmore.

Rare whisky topped the Knight Frank Luxury Investment Index in 2019, surging in value by 40% over the previous 12 months from the last quarter of 2018. The same report also shows that, over the past decade, whisky values have gone up six-fold.

The Asian market has played a significant role in driving the rise in the value of investing in Scotch whisky. According to the Scotch whisky Association, single malts now account for almost one-third of total Scottish exports with the sales of whisky to India, China and Singapore rising by 44%, 35% and 24% respectively in the first half of 2018. Hong Kong remains the hub for whisky auctions, as it acts as a hub for mainland Chinese and other Asian countries to source and obtain the rarest whiskies in the world.

“Turning wholesale whisky into an asset investable for individuals is a very unique idea… whisky's nature — that its value increases as it ages — is completely different from other commodities." - Kazuhiko Saito, Chief Analyst, Fujimoto Co.

How Will AFINUE Help You With Cask Investment?

Afinue.com curates exclusive alternative investment opportunities, helping members diversify their portfolios with high-value assets. Cask investments have long been valued for their rarity, craftsmanship, and historical significance. As interest in alternative investments grows, cask ownership is emerging as a unique way to diversify portfolios with a tangible asset.

Our structured investment model operates through a special purpose vehicle (SPV), held offshore from India. This SPV directly acquires and holds whisky casks via trusted exchanges or intermediaries, ensuring investors maintain rights over their physical assets while enjoying the flexibility of structured trade opportunities across multiple exchanges.

If you're interested in learning more about how to invest in whisky casks, connect with us at Deals@afinue.com.

Let’s explore how whisky can be a rewarding addition to your investment portfolio.

Bibliography:

[1] https://www.goodreads.com/quotes/54577-too-much-of-anything-is-bad-but-too-much-good

[2] https://www.whiskyinvestdirect.com/

[3] Nationwide.co.uk

[4] Scotch Whiskey Industry Review (Alan S Gray) and UK RPI from the Office for National Statistics

[5] https://us.braeburnwhisky.com/

[6] www.essentialmagazine.com/how-to-invest-in-whiskey

[7] businessindia.co/magazine/the-whiskey-exchange-brothers

[8] Data source: IWSR, Scotch Whiskey Industry Review 2015 – Alan S Gray

Related Blogs

10-01-2023

Why is Whisky a Good Investment?

Whiskey is an untapped niche for serious investors and, in a period when redundant capital has chased up the prices of nearly everything else, it is worth a look, on those grounds alone.

12-07-2023

Being serious about ‘Horse’-ing around

Horse ownership is not limited to only the ultra-wealthy. Read more on fractional ownership avenues to participate in this equestrian world.

13-01-2025

Housing 31 Million Students, Will it be a Challenge?

Step into India's evolving world of purpose built student accommodation, where affordable student housing, modern campus living, and innovative investment opportunities redefine smart choices.

29-06-2023

550% returns in 13 years on a physical asset

Since 2010, gold has given a 200% return and silver 167%. Most people would be happy with those numbers. But imagine making over a 550% return on your investment, while being able to wear and flaunt it!

10-01-2023

Can you invest in wine - What you need to know

Wine has been an investment asset class for as long as humanity has known to produce it. Unlike Whiskey, where you let it mature for equity gains, wine’s value grows even when stored in bottles, as the vintage and provenance matter in pricing