550% returns in 13 years on a physical asset

29-06-2023

550% returns in 13 years on a physical asset

Since 2010, gold has given a 200% return and silver 167%. Most people would be happy with those numbers. But imagine making over a 500% return on your investment, while being able to wear and flaunt it.

In hindsight, this is an opportunity you probably missed out on; Rolex Submariner Hulk was released in 2010 for USD 8,900 and today it sells for nothing less than USD 32,000. But that’s only a 260% return, right? Why did we say you could have made more than a 500% return then? Well, it’s the currency appreciation or inflation impact, whichever way you wish to look at.

When you consider the INR depreciation, the returns are staggering. The watch retailed at ₹4 Lakhs in 2010 and now sells for nothing less than ₹26 Lakhs. A 550% return.

Furthermore, this is not an anomaly. The Rolex Daytona Panda has given collectors a return of 275% on their investment between its launch in 2016 at ₹8 Lakhs and its current market value at ₹30 Lakhs. In the same time period (2016-present), gold has given a return of 93% and silver 95%.

People purchase timepieces for a variety of reasons. Some are fascinated by the engineering and craftsmanship that go into making an exquisite watch, others appreciate a brand's history and heritage, while people use timepieces as a way to express their individual sense of style.

Given the price rise of new luxury watches, the market for collectible watches is also growing quite fast. This is partly because there is a short supply of these timepieces. As more and more people express interest in collecting timepieces, the price of watches is only expected to rise.

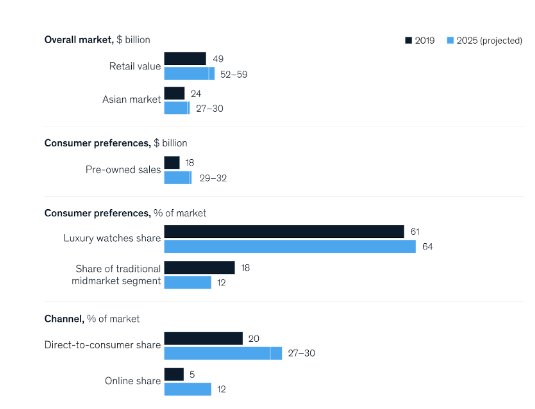

According to a McKinsey report, the pre-owned watch market is set to become the collectible industry’s fastest-growing segment, reaching between USD 29 to USD 32 billion in sales by 2025. Driven by younger consumers in addition to collectors and cost-conscious shoppers, aided by as an increasingly trustworthy and transparent supply eco system built by digital marketplaces.

Rising disposable incomes in Asia-Pacific, driven by economic growth and urbanization, are providing consumers with more spending power for luxury goods, including watches. Consumer behavior in the region is shifting, with luxury watches being viewed as status symbols and a means of personal expression.

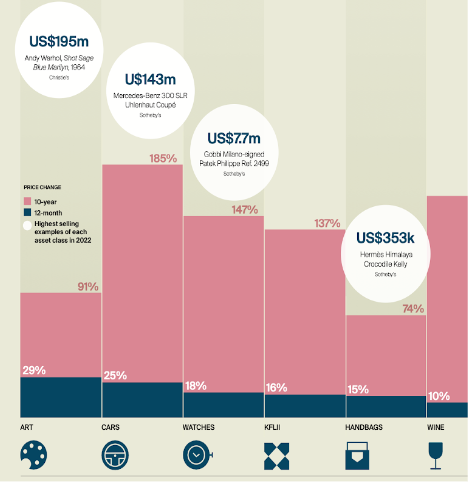

In 2022, watches took third place on the Knight Frank Luxury Investment Index (KFLII) list with 18 per cent annual appreciation on investment.

Knight Frank India's chairman and managing director, Shishir Baijal, said "India's wealthy have always had a penchant for collectibles across categories, however traditionally these were mostly for conservation, rather than investments. With the domestic and global market offering significantly higher returns for such article, Indian ultra-wealthy are actively seeking investment opportunities in passion led investments.”

Timepieces have the potential to increase in value over time, especially those from reputable companies, limited editions, or vintage models. Price increases in the secondary market can result from a mix of brand recognition, scarcity and collector demand, providing the chance for capital growth and potential returns on investment.

Approximately 800,000 watches are produced by Rolex each year, but due to the brand's fame, demand far exceeds supply, sustaining a thriving secondary market for pre-owned watches.

In fact, the average sales data for Rolex show a rise beginning in 2017 and a further rise in 2020. As of February 2022, the average Rolex price was ~ USD13,000, more than three times the $5,000 average from 2011.

Investing in watches from reputed brands or even limited edition ones is undeniably a compelling opportunity that is worth exploring for those with the means. It is impossible to deny the appeal of having a high-end timepiece that emanates craftsmanship, elegance, and status. However, if purchasing such timepieces is out of your current financial reach, there are other ways to get involved in the luxury watch market that can still be rewarding.

Fractional ownership is an exciting concept that has given more people access to the world of exquisite watches. Through fractional ownership platforms, individuals can access exclusive and coveted timepieces without requiring full ownership. This unique approach enables investors to purchase shares in these timepieces, sharing in their ownership and reaping the benefits that come with the value appreciation, however not so much of the brag factor from wearing those.

Through fractional ownership, you may diversify your financial portfolio and diversify small investments in a variety of premium watches from renowned brands. Diversification provides a level of stability and protects investors from potential low gains associated with investing heavily in only a single watch. This is a growing trend in the global market, with platforms like “Investables” allowing investors to buy shares in collectible watches, making it possible to own a piece of a luxury timepiece without having to spend a fortune,sometimes as low as USD 10 a share for a time piece of USD 50,000

In the US, the Securities and Exchange Commission (SEC), allows for such platforms to be registered with them, which means that such platforms are subject to the same regulations as any other SEC-registered investment platform. Mostly, all such platforms globally hold these collectibles, like watches, that they fractionalize, in a secure vault, in a free port, like those in Switzerland. Generally the vaults are insured and access to the vaults are restricted to authorized personnel only.

The Securities and Exchange Board of India (SEBI), has recently taken a similar approach towards fractional ownership, though focused on Real Estate assets. In a recent discussion paper, SEBI proposed regulations aimed at safeguarding investors through disclosure requirements, investor protection measures, and risk management protocols, covered under a “SME ReIT” structure. These proactive steps reflect SEBI's commitment to creating a transparent and secure investment environment, fostering investor confidence in fractional ownership opportunities in India, as we hope the coverage of such regulations will cover non real estate physical investment assets as well.

Currently in India, as in many other Asian countries, while there are platforms offering fractional ownership of investible physical assets, there is no one offering fractional ownership of alternate assets in the collectibles space, as yet. This is the gap that AFINUE is working on and hopes to fill, as we build a unique tech enabled wealth management platform that democratizes alternate assets.

Join us as we transform the landscape of alternate investments in India. Stay tuned for developments and be among the first to experience the opportunities that AFINUE will soon open up for the world of alternative assets. Let's start a new era of investment together. Be sure to follow us on social media and subscribe to our newsletter.

Related Blogs

10-01-2023

Why is Whisky a Good Investment?

Whiskey is an untapped niche for serious investors and, in a period when redundant capital has chased up the prices of nearly everything else, it is worth a look, on those grounds alone.

12-07-2023

Being serious about ‘Horse’-ing around

Horse ownership is not limited to only the ultra-wealthy. Read more on fractional ownership avenues to participate in this equestrian world.

13-01-2025

Housing 31 Million Students, Will it be a Challenge?

Step into India's evolving world of purpose built student accommodation, where affordable student housing, modern campus living, and innovative investment opportunities redefine smart choices.

29-06-2023

550% returns in 13 years on a physical asset

Since 2010, gold has given a 200% return and silver 167%. Most people would be happy with those numbers. But imagine making over a 550% return on your investment, while being able to wear and flaunt it!

10-01-2023

Can you invest in wine - What you need to know

Wine has been an investment asset class for as long as humanity has known to produce it. Unlike Whiskey, where you let it mature for equity gains, wine’s value grows even when stored in bottles, as the vintage and provenance matter in pricing