Sizing REITs: Small, Medium or Extra Large?

17-12-2024

Sizing REITs: Small, Medium or Extra Large?

Original Publish Date - 17-12-2024

Updated on: 10-03-2025

Did you know that India’s first SM-REIT IPO got listed on 10th December, 2024?

The Rs. 353 crore initial public offering (IPO) of India’s first registered small and medium real estate investment trust (SM REIT) Property Share Investment Trust (PSIT) created much noise. It was over-subscribed by 1.19-1.2 times on its closing date with 4,002 units against the offered 3,353 units, according to data available on the stock exchange.[1]

The first scheme under the PSIT SM-REIT is PropShare Platina which covers six floors of office space in Bengaluru.

This is an important milestone for India’s real estate sector. But why?

It raises the perennial question: is real estate a good investment in today’s dynamic market, especially as innovative vehicles like SM-REITs emerge.

Across the globe, REITs have been an investor-favourite asset class, outperforming many traditional ones by providing steady returns.

In CY2023, 170 million Americans, roughly 50% of the American population, owned REIT stocks directly or indirectly through mutual funds, 401(k) plans, pension plans, and other investment funds according to Nareit.[2]

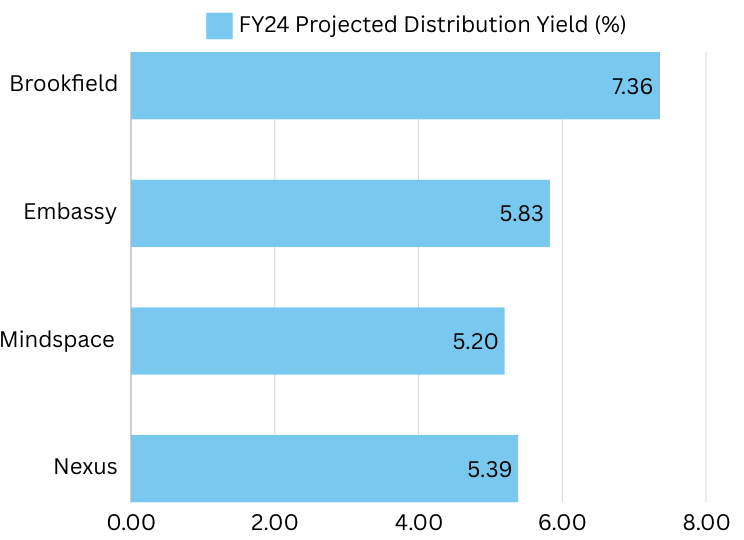

And back home in India, Brookfield India REIT and Embassy Office Parks REIT is projected to have a distribution yield of 7.36% and 5.83% in FY2024. Investors keen on understanding how to invest in REITs in India are closely monitoring these developments.

Over the last few years, fund houses including ICICI Prudential and Aditya Birla Sun Life have also invested in REITs, ~Rs.687.7 crores in Embassy Office Parks REIT[3] and ~Rs. 134.0 crores in Brookfield India REIT[4] as of 10th December, 2024.

REITs have shown resilience even through challenging times like the COVID-19 pandemic with cumulative net assets of listed REITs exceeding INR 90,000 crores in September 2023.[5]

Source: ICICI Direct[6]

But What Is A REIT?

Imagine you are able to invest in ~50 million sq. ft. of real estate space, including offices for large multinationals, 1,614 hotel keys and 100 MW solar projects, with the same ease as purchasing an equity stock, and the same amount of capital in hand. This is what an investor in Embassy’s REIT is able to do.

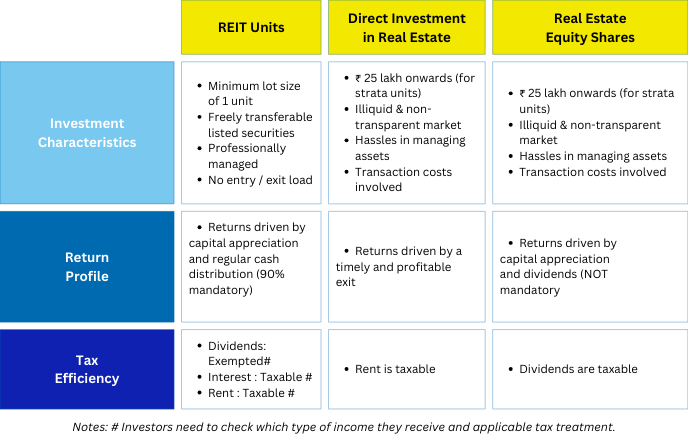

REITs are structured as trusts that own, operate, and finance income-generating properties. They invest the money of individual investors and generate income through operations (such as lease rent, hotel revenue, power generation). REITs are a global example of fractional ownership wherein investors split the costs and the benefits of owning an asset.

For many, this presents an alternative approach to real estate investment in India, offering liquidity and steady returns through rental income, much like real estate mutual funds.

Owning large real estate in the earlier times was an exclusive act for society’s riches. This historical limitation contributed to financial inaccessibility, which REIT in India effectively addressed by enabling investments at smaller ticket sizes (starting at INR 10,000 in some cases). By allowing retail investors to enter the real estate sector with minimal capital, REITs have broadened accessibility, making it easier for those wondering how to invest in real estate with limited funds.

The U.S. Congress created the REIT framework in 1960, allowing Americans to pool resources and invest in real estate assets collectively.

Since then, REITs have rippled over into 40 other countries such as Singapore, Australia, France, and Germany.

India introduced its REIT framework in 2014 with the Securities and Exchange Board of India (SEBI) formalising regulations. This was done with the stated intention of providing benefits such as regular income, accessibility to quality real estate and, liquidity to investors by allowing trading on the stock exchange.

The first REIT Embassy Office Parks got launched in 2019 (5 years ago) and was backed by global private equity (PE) player Blackstone.

To make things interesting: All listed REITs are backed by PE players and the largest commercial office space owner in India (DLF Limited) is yet to launch a REIT.

This raises many questions among those evaluating, “is real estate a good investment?” and why a major player like DLF with high-quality office spaces in Gurgaon, Noida, and Chennai remains absent from the REIT space.

Let’s Get To The Basics

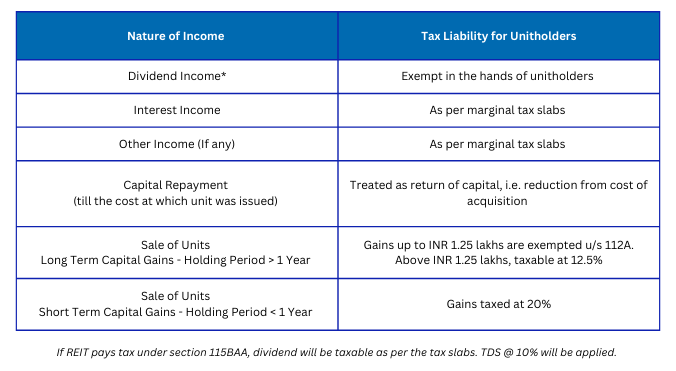

Distribution: REITs have to distribute at least 90% of their net distributable cash flow to unitholders. These distributions can come in the form of:

- Interest income: from debt investments made by the REIT

- Dividends: from the profits of the underlying properties

- Rental or any other form of income

Source: SEBI[7]

The Question of Residentials

Investments in residential real estate in India have historically offered lower rental yields compared to other asset classes, such as commercial real estate. On average, residential rental yields are approximately 2–4% annually, which is significantly lower than commercial properties that yield 6–8% annually. Bengaluru had a rental yield of 4.45% in Q1 2024 followed by Mumbai at 4.15% and Gurugram at 4.1%.[8]

For high yield real estate, commercial assets have traditionally been referred to which come at a higher investment value. This drift of things has driven many investors to explore real estate investment in India options, including REIT investment in India, as a way to achieve better returns

However, Germany serves as a strong example for successful residential REITs. German residential properties offer competitive rental yields due to a strong culture of renting over homeownership. More than 50% of Germans rented their homes in 2023[9]; creating a steady rental income.

There is lesser scope for residential REITs in India, at least until home ownership is no longer aspired.

SM-REITs: Filling a Critical Gap

According to a report by Mint[10], India's non-REIT, private fractional real estate ownership market was valued at ~INR 4,000 crores in 2023 and is set to be valued at ~$5 billion by 2030.

Typically, these real estate assets fall below the INR 500 crore, a minimum threshold required for REIT, leaving many yield generating assets outside the purview of SEBI, requiring the asset owners to resort to raising capital from non-SEBI regulated structures.

So, while REITs added more cards to the investment table for the regular investor, they focused on large-scale spaces.

Which is why on March 8 2024, SEBI provided a regulatory framework for SM-REITs, following the consultation paper on Micro Small and Medium Real Estate Investment Trust (MSM-REITs) issued in May 2023.

These regulations created a structure for Fractional Ownership Platforms (FOPs) which would serve as a foundation for SM-REITs.

By definition, SM-REITs are a new asset class regulated by SEBI as a subclass under REIT. They provide a mechanism for asset owners to raise funds for assets valued between INR 50 and INR 500 crores.

As stated by SEBI, “the framework helps in the development of the real estate sector and all related sectors of the economy.”[11] SM-REITs can become a key driver of development, boosting access to small but high-growth markets, coinciding with the government’s push for financialisation of private investments.

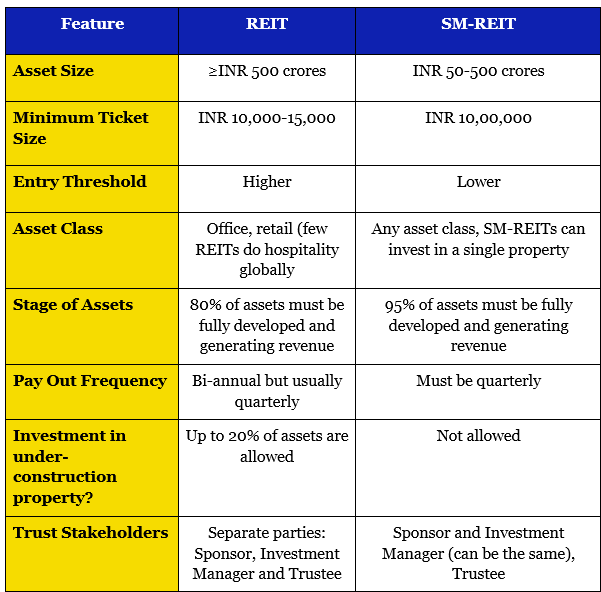

REIT vs. SM-REIT: Key Differences

In traditional REITs, a Sponsor is usually a real estate company that sets up and transfers properties to REIT. It provides it with assets to manage and earn income from.

However, in SM-REITs, there is no need for a separate entity to be a Sponsor. Instead, the responsibilities of the Sponsor are combined with the role of the Investment Manager.

The Investment Manager can be a self-sponsored entity that can offer their own properties and manage the investment.

Apart from this, they are responsible for unit issuance, listing, determining distributions to unitholders through timely disclosures, and addressing investor grievances effectively.

A Trustee is appointed by the sponsor, who holds the assets on behalf of the unitholders. They are also responsible for ensuring that the business activities and investment policies comply with the provisions of the regulations.

The maximum asset size allowed for SM-REITs aligns with the minimum requirement for traditional REITs. With no regulatory restrictions on the number or physical size of assets, SM-REITs can include smaller, rent-generating properties.

The minimum ticket size is considerably higher for SM-REIT, positioning it towards specific investors such as affluent Indians including high-net-worth individuals (HNIs), non-resident Indians (NRIs) and overseas citizens of India (OCIs) who might have more experience in investing in real estate or can seek professional guidance making them equipped to handle risks while capitalising on the potential rewards.

Investing in SM-REITs can offer higher potential returns due to the focused nature of the investment. It allows for more targeted growth in specific properties or regions, which, if successful, can outperform a broader, diversified portfolio.

The regulation requiring SM-REITs to invest 95% of their collected funds in fully developed and revenue-generating real estate projects serves as a protective measure for investors by eliminating the risks associated with speculative or under-construction assets.

REITs can allocate 20% of assets to under-construction or newly developed properties, developmental projects and other permitted assets (e.g., government securities or money market instruments). This 20% allocation provides REITs with an opportunity to capitalise on rising property values, develop new real estate projects to expand their portfolios, and diversify their income sources in the long term.

Lessons From Around the World

The listing of this IPO marks a significant moment for the Indian economy. India’s SM-REITs market is expected to surpass USD 60 billion by 2026 according to CBRE Research.[12] This is powered by India's 300 million sq. ft. commercial office space in Mumbai, Delhi, Bengaluru and Hyderabad as of June 2024. Other cities, including Pune and Kolkata may serve to be contributors to this growing market.

However, limiting oneself to commercial office spaces may neglect asset classes that could be highly fruitful. Factor in the rising demand of warehouse spaces fueled by e-commerce and supply chain expansion or the boom in student accommodation, malls, hotels, hospitals and shopping centres.

Mature markets such as the U. S[13] and Singapore have opened the REIT space to cell towers, data centres, self-storage facilities, luxury hotels, hospitals in the last few decades.

The U.S. REIT market is highly developed, with REITs accounting for about 98.9% of the total listed real estate. Meanwhile, S-REITs in Singapore have expanded geographically with many holdings pan-Asia and beyond. Over 90% of the REITs[14] and property trusts in Singapore have overseas asset exposure. Cross-border S-REITS and property trusts have enabled investors in Singapore to diversify geographically while benefiting from a stable home-market framework.

What is AFINUE Doing in This Space?

AFINUE is curating the next thing in real estate that goes beyond office spaces: fractional ownership of holiday resorts and hotels in high-demand destinations such as Lonavala, Goa, and Alibaug.

And Why:

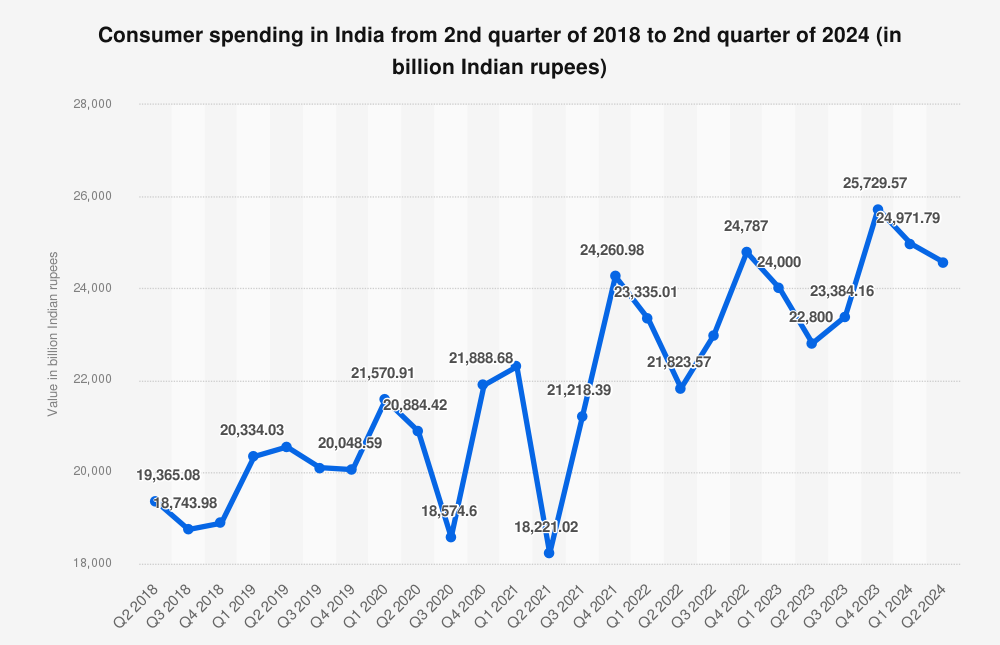

India's consumption has seen significant growth due to rising disposable incomes. “Consumer spending across India amounted to 24.57 trillion rupees by the end of the second quarter of 2024. It reached an all-time high during the fourth quarter of 2023.”[16] According to People Research on India's Consumer Economy (PRICE)’s pan-India survey of 40,000 households in 25 states: India’s rich would make up nearly a third of the population by 2047.[17]

Source: Statista[17]

We are shifting towards an experience economy where consumers prefer experiences over material objects. Travel reflects this trend: in 2023, 2509.63 million Domestic Tourist Visits (DTVs) were recorded (provisionally) compared to 1731.01 million DTVs in 2022.[18] Mahindra Holidays were expecting occupancy to cross 85% after Q3FY23 versus 74% during the pre-pandemic era.”[19]

There's a demand for premium real estate that aligns with the aspirations of the new and affluent middle class. Consumers are on the constant look-out for products that are high-quality, and that portray their status and wealth. Luxury real estate sales rose by 28% in 2023, signaling the preference for premium real estate.[20]

The shift toward experience-driven consumption, premiumization combined with a growing inbound tourism market represents the potential of the hospitality sector.

Moreover, as more investors learn how to invest in real estate and how to invest in REITs in India, tracking metrics such as REIT share price becomes critical, especially when considering flagship offerings like Embassy REIT.

Our approach involves identifying and curating a set of unique properties in said high-growth areas, acquiring them, and collaborating with operators to ensure management and steady rental income. This has been on our radar for a while, awaiting the right regulatory environment.

In September 2021, we curated our first transaction in this space. Since then, we have conducted due diligence, evaluated properties, and fine-tuned structures to align with SM-REIT regulations, ensuring a strong potential for investor exits through SM-REITs. We have tried to create a structure that maximises post-tax investor returns while maintaining effective controls for value protection which has also been validated by big 4 consultants. Our approach is aligned with the Financial Bill 2024, incorporating changes in capital gains tax regulations.

With the SM-REIT framework in place, we believe the time is ripe for such an offering. For those asking, “is real estate a good investment?”, our model provides clear guidance on how to invest in REITs in India while offering exposure to quality, income-generating assets.

India is Ready and so are We. Watch Out for More!

Disclaimer: The information provided in this blog is for informational and educational purposes only and should not be construed as investment advice, financial guidance, or a recommendation to invest in any specific Real Estate Investment Trust (REIT) or Small & Medium REIT (SM REIT). Any REITs mentioned in this article are for representation purposes only and do not constitute an endorsement or solicitation to invest. Investing in REITs and SM REITs involves risks, and readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and publisher of this blog assume no responsibility for any investment decisions made based on the information provided herein.

Bibliography:

[1] Business Standard. (2024, December 4). PropShare Platina IPO gets 1.2 times subscription on final day of bidding. Retrieved from https://www.business-standard.com/markets/ipo/propshare-platina-ipo-gets-1-2-times-subscription-on-final-day-of-bidding-124120401034_1.html

[2] CBRE. (n.d.). Navigating the SM REIT landscape: A look at regulations and implications. Retrieved from https://www.cbre.co.in/insights/reports/navigating-the-sm-reit-landscape-a-look-at-regulations-and-implications

[3] Dollars and Sense. (2024). How REITs performed in 1H 2024. Retrieved from https://dollarsandsense.sg/reits-1h-2024-performed/

[4] Economic Times. (2024). India’s first SM REIT IPO from Property Share opens today: Check key dates, price band, subscription, and other details. Retrieved from https://economictimes.indiatimes.com/markets/ipos/fpos/indias-first-sm-reit-ipo-from-property-share-opens-yoday-check-key-dates-price-band-subscription-and-other-details/articleshow/115881647.cms

[5] Economic Times. (2024). India’s SM REITs market is expected to surpass $60 billion by 2026, backed by over 350 mn sq ft of completed commercial office space. Retrieved from https://economictimes.indiatimes.com/industry/services/property-/-cstruction/indias-sm-reits-market-is-expected-to-surpass-60-billion-by-2026-backed-by-over-350-mn-sq-ft-of-completed-commercial-office-space/articleshow/113092334.cms

[6] Federal Statistical Office of Germany. (2023). Rented accommodation in Germany: Key statistics and insights. Retrieved from https://www.destatis.de/Europa/EN/Topic/Population-Labour-Social-Issues/Social-issues-living-conditions/RentedAccommodation.html

[7] Hindustan Times. (2024, April 5). Bengaluru tops list of cities with highest rental yield of 4.45% in Q1 2024, Mumbai second with 4.15%. Retrieved from https://www.hindustantimes.com/real-estate/bengaluru-tops-list-of-cities-with-highest-rental-yield-of-4-45-in-q1-2024-mumbai-second-with-415-101714383448979.html

[8] ICICI Direct. (n.d.). Real Estate Investment Trusts. Retrieved from https://www.icicidirect.com/fd-and-bonds/real-estate-investment-trust

Livemint. (n.d.). Brookfield India Real Estate Trust REIT: Mutual fund shareholding. Retrieved from https://www.livemint.com/market/brookfield-india-real-estate-trust-reit-mutual-fund-share-holding-S0005137

[9] Livemint. (n.d.). Embassy Office Parks REIT: Mutual fund shareholding. Retrieved from https://www.livemint.com/market/embassy-office-parks-reit-mutual-fund-share-holding-s0003366

[10] Live Mint. (2024). SM REIT IPO: PropShare Platina IPO, Property Share Investment Trust, Prestige Tech Platina. Retrieved from https://www.livemint.com/market/ipo/sm-reit-ipo-propshare-platina-ipo-property-share-investment-trust-prestige-tech-platina-11733110905408.html

[11] Livemint. (2023, March 15). Real estate: How fractional ownership is redefining the rules of investing for small investors. Retrieved from https://www.livemint.com/money/personal-finance/real-estate-how-fractional-ownership-is-redefining-the-rules-of-investing-for-small-investors-11714721825502.html

[12] Moneycontrol. (n.d.). Why have mutual funds increased exposure to REITs and InvITs? Retrieved from https://www.moneycontrol.com/news/business/personal-finance/why-have-mutual-funds-increased-exposure-to-reits-and-invits-6510181.html

[13] Moneycontrol. (n.d.). Over 1 bn Indians to make up middle class when India will turn 100, finds Price survey. Retrieved from https://www.moneycontrol.com/news/business/economy/over-1-bn-indians-to-make-up-middle-class-when-india-will-turn-100-finds-price-survey-10907971.html

[14] Nareit. (n.d.). History of REITs. Retrieved from https://www.reit.com/what-reit/history-reits

[15] Nareit. (n.d.). REIT sectors. Retrieved from https://www.reit.com/what-reit/reit-sectors

[16] Press Information Bureau. (n.d.). Factsheet on government initiatives for real estate development. Retrieved from https://pib.gov.in/FactsheetDetails.aspx?Id=149085

[17] Price360. (n.d.). The rise of India’s middle class: A force to reckon with. Retrieved from https://www.price360.in/expertview/the-rise-of-indias-middle-class-a-force-to-reckon-with/

[18] PropShare. (2024). Fractional ownership research report. Retrieved from https://propmedia1.propertyshare.in/documents/knowledge-centre/research-report/55/Fractional_20240529114004_6656c6bcaa37b.pdf

[19] PwC. (2019). Worldwide REIT regimes. Retrieved from https://www.pwc.com/gx/en/asset-management/assets/pdf/worldwide-reit-regimes-nov-2019.pdf

[20] Reuters. (2024, May 30). India's home prices rise steadily as affordable housing supply lags demand. Retrieved from https://www.reuters.com/world/india/indias-home-prices-rise-steadily-affordable-housing-supply-lag-demand-2024-05-30/

[21] SEBI. (2022). Presentation on REITs. Retrieved from https://investor.sebi.gov.in/pdf/reference-material/ppt/PPT-10%20Updated%20PPT%20on%20REITs_approved%2030%20Sep%202022.pdf

[22] Securities and Exchange Board of India. (2023, November). Consultation paper on amendments to SEBI (Real Estate Investment Trusts) Regulations, 2014. Retrieved from https://www.sebi.gov.in/sebi_data/meetingfiles/nov-2023/1701238466470_1.pdf

[23] SGX Research. (2024). S-REIT & Property Trusts Chartbook (2Q24). Retrieved from https://api2.sgx.com/sites/default/files/2024-08/SGX%20Research%20-%20SREIT%20%26%20Property%20Trusts%20Chartbook%20-%202Q24_0.pdf

[24] Statista. (n.d.). Household expenditure in India. Retrieved from https://www.statista.com/outlook/co/consumption-indicators/india#household-expenditure

[25] The Economic Times. (2023, January 22). Adrenaline junkies are giving shape to a fast-growing experience economy. Retrieved from https://economictimes.indiatimes.com/industry/services/travel/adrenaline-junkies-are-giving-shape-to-a-fast-growing-experience-economy/articleshow/97208725.cms

[26] The Secretariat. (n.d.). Will the Hindenburg report dent India’s rapidly growing REITs segment? Retrieved from https://thesecretariat.in/article/will-the-hindenburg-report-dent-india-s-rapidly-growing-reits-segment

[27] Zerodha Varsity. (n.d.). Small and medium REITs explained: A new investment option for Indian investors. Retrieved from https://zerodha.com/z-connect/varsity/small-and-medium-reits-explained-a-new-investment-option-for-indian-investors

Related Blogs

29-10-2025

Goa’s Real Estate Evolution: From Holiday Haven to Investment Powerhouse

What turned Goa from a tourist spot into India's fastest-growing property market? Read the blog to know how India's coastal paradise transformed into an investment hotspot.

29-08-2025

From Retreat to Returns: The Rise of Holiday Rentals in India

Holiday homes in India have evolved from family getaways to lucrative investment assets. Discover how shifting preferences, remote work, Airbnb, and fractional ownership are reshaping the holiday home to holiday rental market and how AFINUE is helping investors be a part of it.

01-10-2025

REITs, InVITs, and Real Estate Tokenization: Transforming Property Investments

Explore how REITs, InVITs, and real estate tokenization are transforming property investments. Learn how these financial instruments provide liquidity, diversification, and access to high-value real estate for investors, making property investment easier.

28-08-2025

Driving Tourism and Delivering High Yields: The Rise of Hotel Apartment Investments in Dubai

Read How Dubai hotel apartments evolved from pre-COVID growth to post-COVID resilience, now offering investors high yields and global credibility.

02-08-2025

From Free Reign to Regulations

Explore how Dubai’s shift from crypto freedom to regulation is reshaping real estate and how AFINUE mirrors this, with fractional ownership in India.

10-01-2023

Invest in Holiday Rentals

Find out more on the business of 'holiday rentals' - whether to invest in a second home, or use the holiday rental platforms to enjoy a staycation