From Free Reign to Regulations

02-08-2025

The Synergistic Growth of Cryptocurrency and Dubai’s Real Estate

Picture this - It's 2020, right after Covid hits the world, a tech entrepreneur from Russia walks into a luxury real estate developer's office in Downtown Dubai. Instead of pulling out a checkbook or arranging a wire transfer, he opens his smartphone, scans a QR code, and within minutes completes the purchase of a multi-million dollar penthouse using Bitcoin. This scenario, which would have sounded like science fiction not so long ago, became commonplace in Dubai during the height of the cryptocurrency boom, after the Covid.

In recent years, Dubai has emerged as a leading global hub for innovation, technology, and financial advancements. Among the many groundbreaking developments that found a home in Dubai, cryptocurrency-fueled real estate transactions quickly became one of the most fascinating. Known for its openness to futuristic concepts, Dubai allowed cryptocurrencies to flourish in ways most other regions were and are still skeptical of. At one point, digital currencies such as Bitcoin, Ethereum, meme coins, and even lesser-known altcoins played a significant role in high-value transactions, including the purchase of luxury cars, designer jewelry, and multi-million dirham properties.

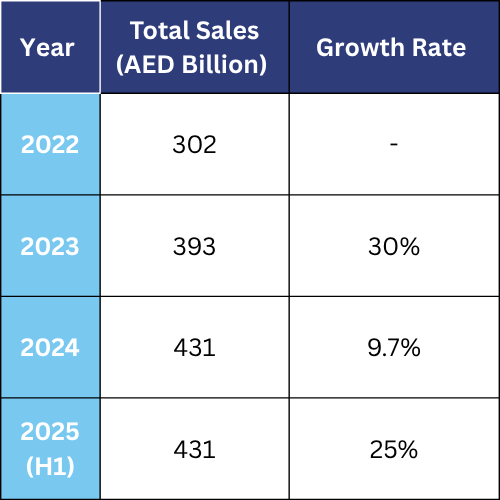

Dubai's Property Market Growth (2022-2025)

*First half of 2025 compared to first half of 2024

Data sources: Dubai Land Department, CBRE UAE, Focus HiDubai

Crypto’s Early Reign in Dubai Real Estate

The earlier stance of Dubai on cryptocurrency was a liberal and welcoming one. Between 2018 and 2022, the Emirate gained attention for allowing high value transactions, including real estate purchases using various forms of digital currencies. Crypto holders from all around the world flocked to Dubai, eager to convert their digital assets into tangible investments. Real estate developers, especially those selling high-end apartments and villas, started partnering with crypto payment gateways to accept crypto payments. The openness fueled a surge in property investments, making Dubai one of the leading cities in the world for cryptocurrency acceptance in high value transactions, even in a regulated product (such as real estate). It aligned with the city’s ambition to be a futuristic metropolis that attracts tech-savvy investors and global alternative investments.

This freedom, however, also brought challenges. While the influx of foreign capital boosted property sales and contributed to economic dynamism, the largely unregulated nature of crypto transactions also opened doors to financial ambiguity. Various cryptocurrencies have been used without thorough regulatory oversight, raising concerns about the legitimacy of some transactions and money laundering risks. Moreover, the highly volatile nature of many cryptocurrencies meant that both buyers and sellers could encounter significant discrepancies in value between the time they initiated and completed a deal (sometimes within the day).

Introduction of VARA

Recognizing the growing complexity and risks associated with this unregulated crypto boom, Dubai began re-evaluating its position. In 2022, the UAE established the Virtual Assets Regulatory Authority (VARA), which went on to introduce a set of frameworks to govern and monitor cryptocurrency usage more closely. These policies didn't ban crypto usage but introduced a more structured approach. A new rule allowed only approved and regulated cryptocurrencies to be used for large transactions, such as real estate purchases, among the biggest shifts.

Unlike earlier times when nearly any digital token could potentially be used to buy a villa or penthouse, now only a select list of stable and VARA-approved cryptocurrencies is deemed acceptable. The list primarily includes well-established assets like Bitcoin, Ethereum, and USDT. Essentially, this allows only those cryptocurrencies that have relatively higher market capitalization, liquidity, and globally established compliance frameworks in place. By streamlining acceptable cryptocurrencies, authorities aimed to bring greater transparency and security to financial transactions without completely stifling innovation.

Initial Dip, Long-Term Gain

The impact on the real estate market was immediate. For one, the volume of property purchases made with cryptocurrencies dipped initially. Investors who had built wealth through speculative altcoins or meme tokens could no longer use them directly to buy properties. They now had to convert these tokens into approved cryptocurrencies, which often involved transaction fees, conversion losses, and compliance verifications. This additional step dissuaded some of the more speculative investors and reduced the overall frequency of crypto-based real estate deals. However, this change isn’t necessarily negative in the long run.

The New Reality: Quality Over Quantity in Crypto Driven Real Estate Transactions

The new regulations introduced a sense of legitimacy and stability in the market. With fewer unregulated transactions, developers and property brokers felt more protected and assured. The entire ecosystem found comfort in knowing that official regulatory standards would now govern crypto-based property transactions, which reduced the risks from volatility in price as well as provided a framework to curb potential money laundering.

Furthermore, the involvement of VARA brought in a layer of trust, which helped attract more institutional investors. Previously, many traditional investors and institutions stayed away from Dubai’s crypto property boom, fearing its informal and unpredictable nature. But with regulated crypto use, Dubai began to appeal not just to individual crypto millionaires but also to larger financial entities and real estate investment funds that wanted exposure to Dubai’s booming property sector through cleaner and more compliant channels.

Additionally, the shift to regulated crypto assets helped mitigate the volatility that had earlier posed a problem. Real estate, being a high-value investment, does take time, from deal initiation to closure, and therefore does not align well with the unpredictable and volatile price movements of most cryptocurrencies.

The Global Context: Dubai as a Regulatory Pioneer

From a macroeconomic perspective, this move has also helped Dubai align with global regulatory trends. As other major financial hubs like Singapore, the UK, and parts of the US move toward formalizing digital asset frameworks, Dubai’s actions show that it wants to lead responsibly in the crypto and in the larger digital, tokenized real assets space, and not just be a mere participant. It aims to balance innovation with prudence, a necessary step for long-term economic sustainability.

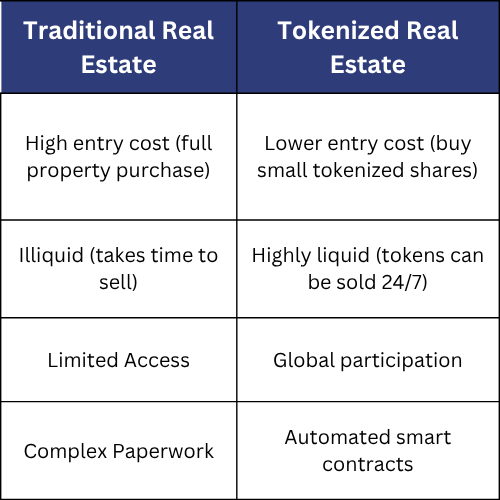

One of the most important steps taken by Dubai’s Virtual Assets Regulatory Authority (VARA) is its push toward the tokenization of real assets. Tokenization is the process of converting physical assets like real estate into digital tokens on a blockchain. Each token represents ownership of a portion of the asset, allowing people to buy, sell, or trade their shares securely and efficiently. This enables fractional ownership of real assets, like real estate, in a simple form, while encouraging newer digital native investors to buy with smaller ticket sizes. Unlike traditional group buying or even REIT structures, being proposed as a regulatory framework in other developing markets, including India, for enabling fractional ownership of Real Assets, VARA’s solution of tokenization is path-breaking.

A combination of regulations that enable real assets to be transacted through tokenization and Cryptocurrency is bound to create a stronger future-ready ecosystem.

However, there are ongoing debates on the benefits. Critics argue that limiting acceptable cryptocurrencies could hinder innovation and exclude new promising technologies from participating in the financial ecosystem and thereby in the financialisation of real assets. For example, emerging blockchain projects with real utility might now be overlooked simply because they’re not on VARA’s approved list. There is also concern about how flexible the system will be in adapting to new tokens, real asset tokenization, and blockchain trends, given how fast the space is evolving.

On the other hand, supporters believe that the policy change is a natural evolution in Dubai’s real estate-backed economic journey. The initial freedom allowed the city to attract global attention with crypto wealth, and now, regulation ensures that this wealth is managed responsibly. This approach echoes the UAE’s and, more specifically, Dubai’s broader pattern in other sectors: open the doors to innovation first, then slowly build a robust regulatory and compliance structure to guide stability.

The Future is Exciting, to say the least!

The evolution of Dubai’s Digital Currency regulatory ecosystem, from broad, unrestricted usage to a more structured framework, has significantly reshaped its real estate market. While the initial boom brought in a rush of crypto investors and boosted property sales, it also came with its share of risks. The new regulations, focusing on select, approved cryptocurrencies, additionally enabling tokenisation of real assets, have not only reduced the number of spontaneous or speculative purchases but have also increased stability, attracted more credible investors, reduced entry barriers, and positioned the city as a leader and beacon for future-ready global financial systems.

For investors, real estate developers, and cryptocurrency enthusiasts, Dubai's story demonstrates that the future of digital assets in real estate lies not in the absence of regulation but in the presence of thoughtful, adaptive governance that protects participants while encouraging innovation. As the emirate continues to evolve its approach to cryptocurrency and real estate, it remains a compelling destination for those seeking to participate in the intersection of traditional property investment and cutting-edge financial technology. Dubai’s transformation from a crypto wild west to a more mature digital economy reflects its ambition to be a forward-thinking yet responsible financial capital of the future.

While VARA’s tokenization framework enables people to buy small, verified shares of real estate using blockchain, AFINUE brings that same spirit to life through curated fractional ownership opportunities, while being aligned to existing Indian regulations.

Whether it’s a luxury holiday home in Goa or a high-demand holiday rental enabled villa in Lonavala, AFINUE helps investors co-own prime real estate and earn from it, without needing to buy the whole asset. Just like Dubai’s push for regulated, shared fractionalized ownership through technology, AFINUE is building a future where property investment is no longer a privilege for the few but a possibility for many. Together, both visions prove that the future of real estate isn’t just digital, it’s also democratic.

Bibliography:

[1] Dubai Land Department Official statistics on real estate sales (2022–2025). Source: https://www.dubailand.gov.ae

[2] Focus HiDubai Market Insights Insights on digital adoption, market growth, and economic trends in Dubai. Source: https://focus.hidubai.com

[3] Virtual Assets Regulatory Authority (VARA) Policies and regulatory frameworks for digital assets and tokenized real estate. Source: https://vara.ae

[4] CoinDesk & Cointelegraph Information on cryptocurrency market acceptance, volatility, and global trends. Sources: https://www.coindesk.com https://www.cointelegraph.com

[5] The National News UAE Articles on the introduction and impact of VARA in Dubai. Source: https://www.thenationalnews.com

Related Blogs

29-10-2025

Goa’s Real Estate Evolution: From Holiday Haven to Investment Powerhouse

What turned Goa from a tourist spot into India's fastest-growing property market? Read the blog to know how India's coastal paradise transformed into an investment hotspot.

29-08-2025

From Retreat to Returns: The Rise of Holiday Rentals in India

Holiday homes in India have evolved from family getaways to lucrative investment assets. Discover how shifting preferences, remote work, Airbnb, and fractional ownership are reshaping the holiday home to holiday rental market and how AFINUE is helping investors be a part of it.

01-10-2025

REITs, InVITs, and Real Estate Tokenization: Transforming Property Investments

Explore how REITs, InVITs, and real estate tokenization are transforming property investments. Learn how these financial instruments provide liquidity, diversification, and access to high-value real estate for investors, making property investment easier.

28-08-2025

Driving Tourism and Delivering High Yields: The Rise of Hotel Apartment Investments in Dubai

Read How Dubai hotel apartments evolved from pre-COVID growth to post-COVID resilience, now offering investors high yields and global credibility.

02-08-2025

From Free Reign to Regulations

Explore how Dubai’s shift from crypto freedom to regulation is reshaping real estate and how AFINUE mirrors this, with fractional ownership in India.

10-01-2023

Invest in Holiday Rentals

Find out more on the business of 'holiday rentals' - whether to invest in a second home, or use the holiday rental platforms to enjoy a staycation